2025 Medium-Term Management Plan (FY3/23-FY3/26)

> For detailed presentation material, please click here.

*Update progress on May 12, 2025. Click to check latest information.

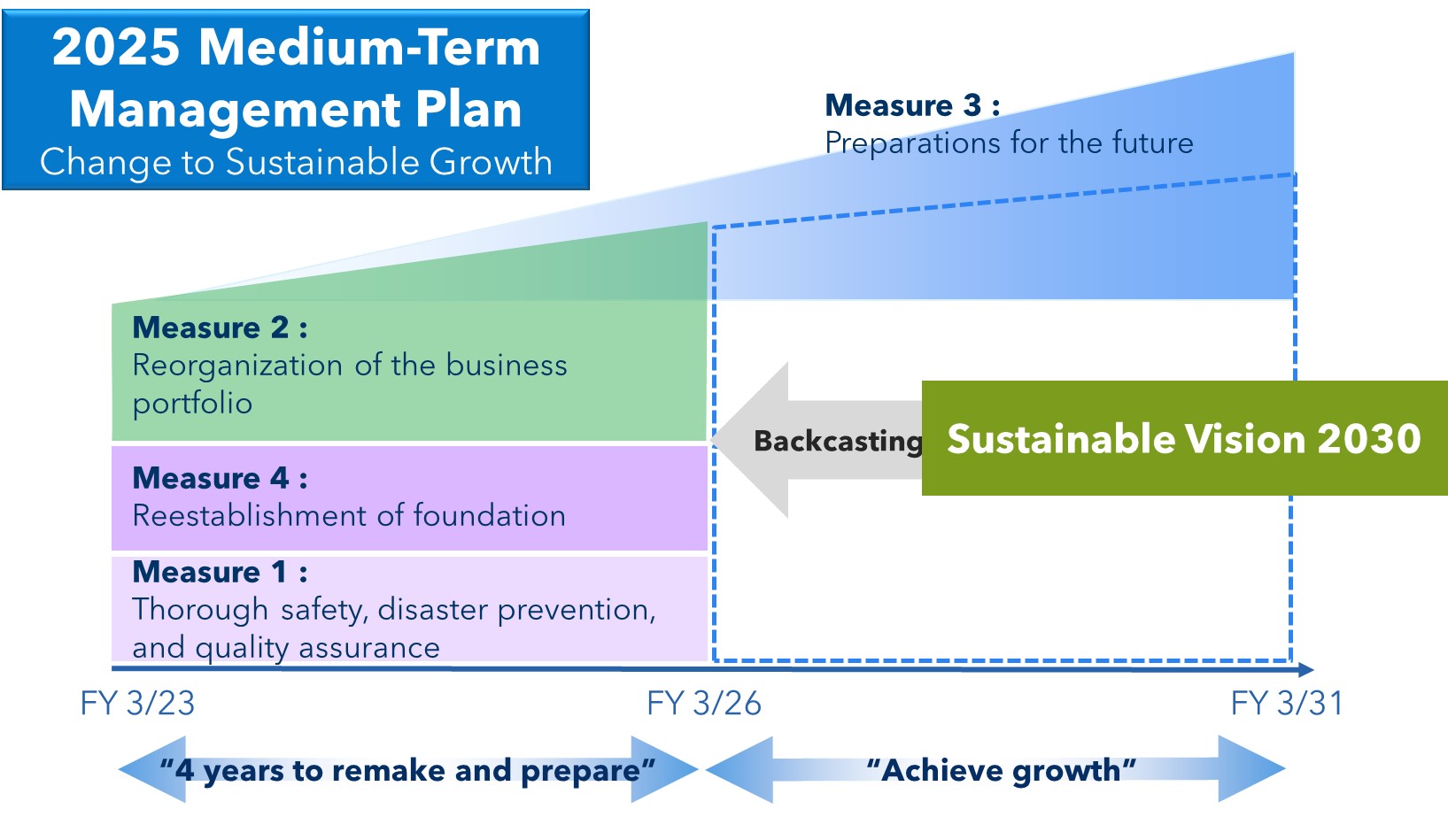

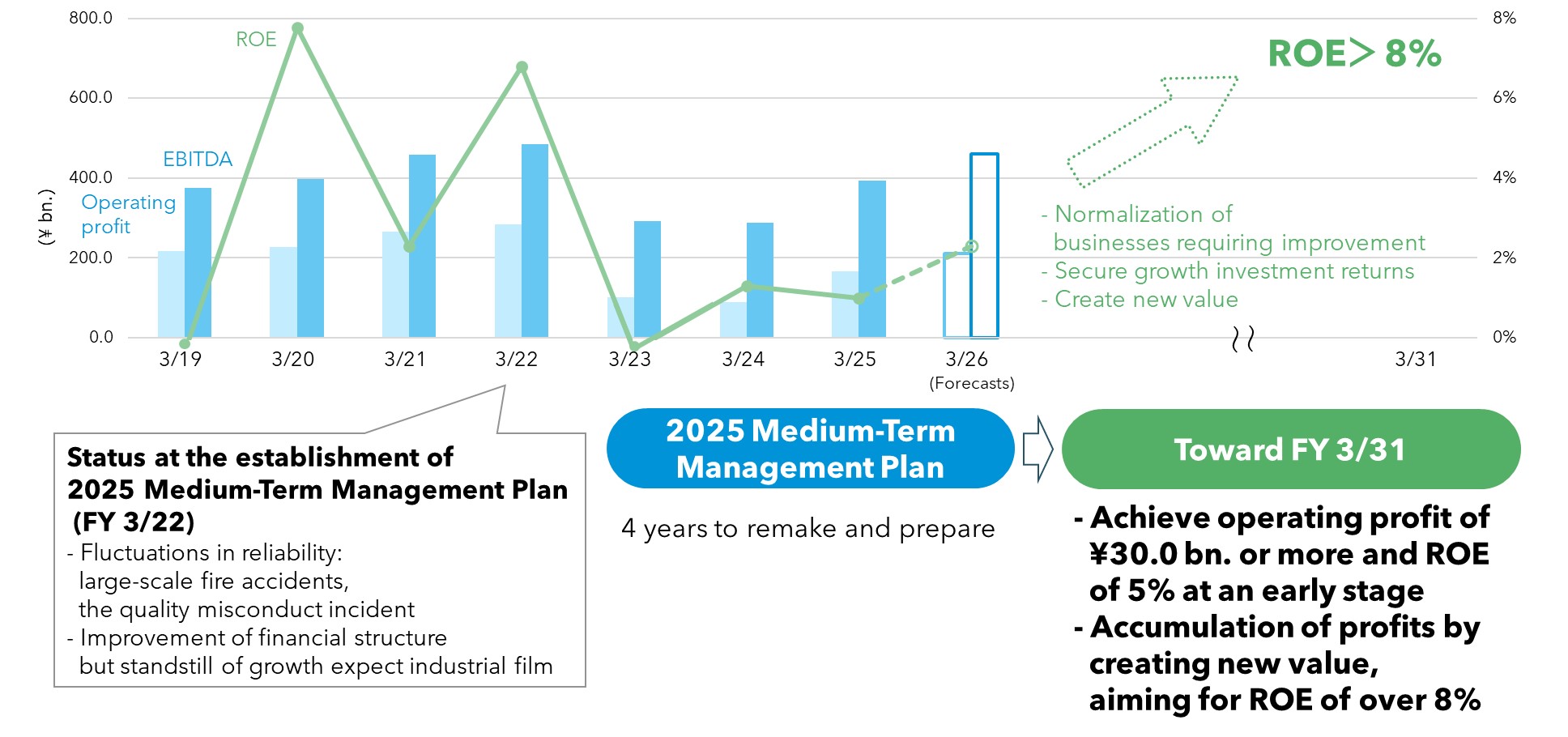

Toyobo Co., Ltd., observed the 140th anniversary of its founding in May 2022. On this occasion, the company stipulated a long-term vision, Sustainable Vision 2030 and 2025 Medium-Term Management Plan (FY 3/23 to FY 3/26).

The Sustainable Vision 2030 predicts change in the future business environment and shows the ideal state of the Toyobo Group in 2030, as well as sustainability indices and action plans, based on its corporate philosophy of “Jun-Ri-Soku-Yu (Adhering to reason leads to prosperity).” Under this long-term vision, the Group is committed to becoming a sustainable company that contributes to (society’s) sustainability, while changing its corporate culture to one oriented toward sustainable growth.

The 2025 Medium-Term Management Plan (FY 3/23 to FY 3/26) regards the period covered by the plan as a pass point in its efforts to attain the goals stipulated in the Sustainable Vision 2030 and four years of remaking and preparation with the aim of building a foundation for sustainable growth based on a basic policy comprising four measures.

Each of four measures are incorporated into the respective action plans to be implemented.

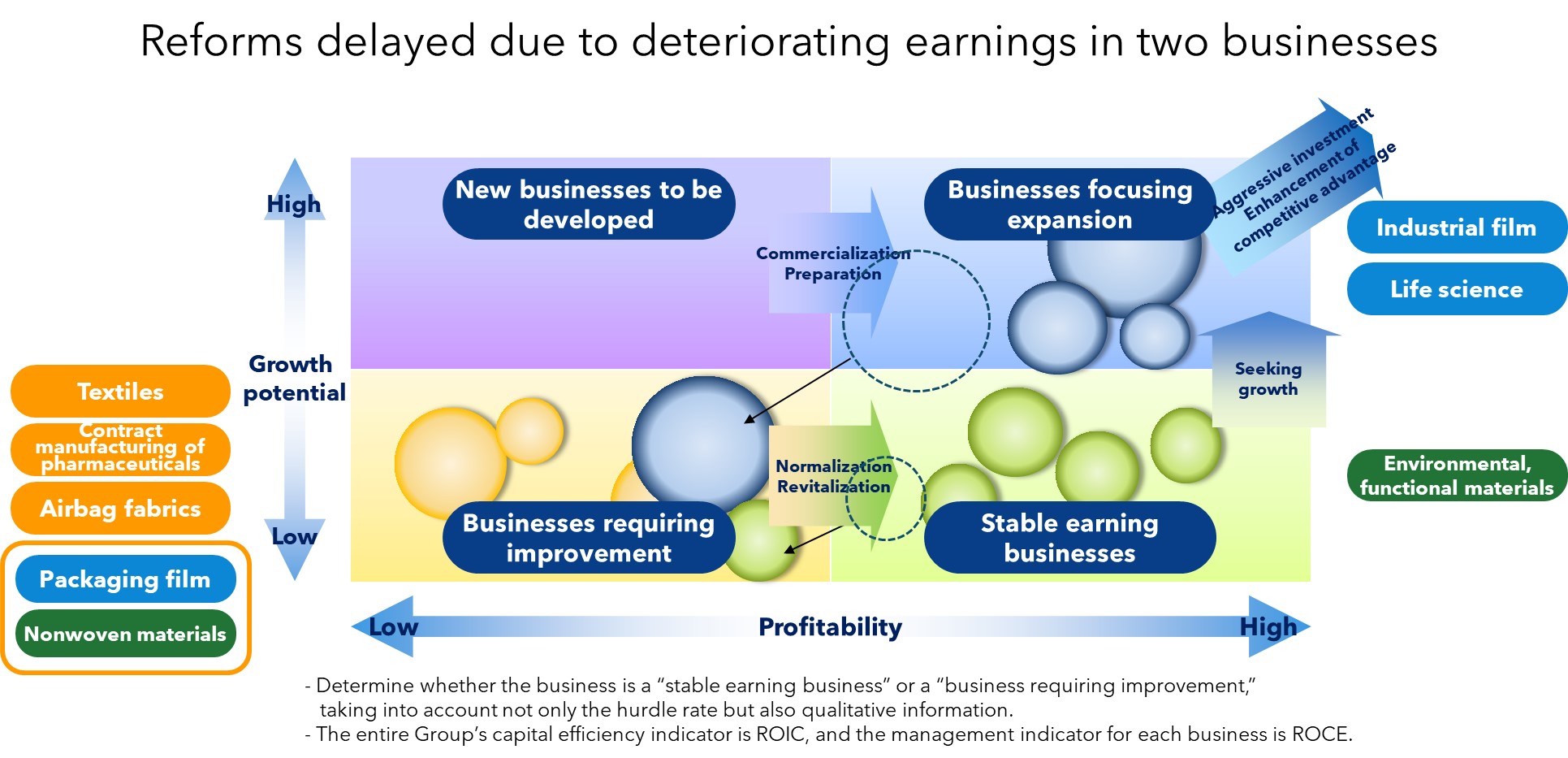

Regarding Measure 2 “Reorganization of the Business Portfolio,” the Group maps each operation in its business landscape on the basis of profitability and growth potential, and categorize it into four quadrants. It then manages each business operation based on its positioning. Hurdle rate of two axes is set as Return on Capital Employed (ROCE) and Compound Annual Growth Rate (CAGR), respectively. When determining whether the business is a “stable earning businesses” or a “businesses requiring improvement,” the company takes into account not only the hurdle rate but also qualitative information. Also, the company considers measures by stratified business.

The Group will continue to actively make investments in film business and life science business as “businesses focusing expansion” because they have a competitive edge and their markets are expected to grow.

In addition, the Group aims to make the field of environmental and functional materials business of “stable earning businesses” as the driver for “third growth” by establishing a joint venture with Mitsubishi Corporation. By combining its technological capabilities and Mitsubishi Corporation’s comprehensive power, including its broad industrial knowledge and networks, Toyobo will aim to boost its presence in the global market and providing solutions to match diverse and complex industrial needs.

Also, the Group will steadily promote master plans to achieve normalization in textile business, airbag fabrics business and contract manufacturing of pharmaceuticals business as “businesses requiring improvement”.

However, the packaging film business and nonwoven materials business suffered a dip in profitability due to shifts in the business environment, such as surging prices of raw materials and fuel. As a result of the above, the positioning of these two businesses was changed to businesses requiring improvement in FY 3/25, and is carrying out measures to improve the profitability of each.

Action plans of four measures and progress made through FY 3/25 is as follows.

(P: As planned、D: Delayed)

|

Action Plan |

Progress |

||

|

Measure 1 |

Thorough safety, disaster prevention, and quality assurance |

- Execute a master plan for safety and disaster prevention “zero accidents” - Reconstruct the quality assurance management structure - Risk management structure |

P: Zero serious incident since FY 3/22 P: Development of safety, disaster prevention structure and progress of acquisition of ISO 45001 certification on each site P: Development of the quality assurance structure and mechanism. Regaining of ISO 9001 certification for engineering plastic and the lifting of the Warning Letter by the FDA for pharmaceuticals |

|

Measure 2 |

Reorganization of the business portfolio |

- Stratify businesses (return on capital employed and growth potential) |

D: Businesses focusing expansion:Growth investment was executed as planned but launch of new equipment was delayed in some areas P: Stable earning businesses: Establishment of TOYOBO MC Corporation. Strengthening of the management base, revision of systems and operations and earnings improvement D: Businesses requiring improvement: - Achieved profitability in textiles (consolidation of domestic production sites, 3 plants → 1 plant) - Airbag fabrics and pharmaceuticals narrowed their losses and were on track to return to profitability - Deterioration of profitability in packaging film and nonwoven materials → Shift to businesses requiring improvement from FY 3/25 (Measures are on the way including the suspension of operations on production lines) |

|

Measure 3 |

Preparations for the future |

- Creation of new businesses and technologies: strengthening of environment and biotechnology related business, and Mirai Pro POC |

P: Setting of three areas of innovation creation. Progress of priority themes P: Legacy systems update in progress. Companywide project to reform operations P: Acquisition of SBT approval, third-party verification of environmental data, and participation in GX League |

|

Measure 4 |

Reestablishment of foundation |

- Promote Human resources development, diversity - Change of the organizational culture |

P: Selection of next-generation personnel. Development of training for onsite leaders and other engineers P: Promote diversity and human rights due diligence P: Development and renewal of business sites and plant infrastructure P: Strengthening the group governance and risk management structure P: Development of compliance structure and training P: Instillation of corporate philosophy framework "TOYOBO PVVs" |

Detailed presentations on films business, life science business and environmental and functional materials business are available on below link.

- Toyobo to establish joint venture with Indorama Ventures to build new plant for automobile airbag yarns (Oct. 26, 2020)

- Toyobo and MC Agree to Establish New Joint Venture in Functional Materials (Mar. 24, 2022)

- Toyobo and Indorama Ventures set to better meet increase in global airbag demand: ceremony held in Thailand marks opening of factory to produce high-performance nylon yarn for the automotive safety sector (Oct. 12, 2022)

-

Toyobo and MC Launch Operations at New Joint Venture Company - “Toyobo MC Corporation” to Specialize in Functional Materials - (Apr. 6, 2023)

(720KB)

Toyobo and MC Launch Operations at New Joint Venture Company - “Toyobo MC Corporation” to Specialize in Functional Materials - (Apr. 6, 2023)

(720KB)

-

Toyobo MC Corporation Management Plan (Apr. 6, 2023)

(1,917KB)

Toyobo MC Corporation Management Plan (Apr. 6, 2023)

(1,917KB)

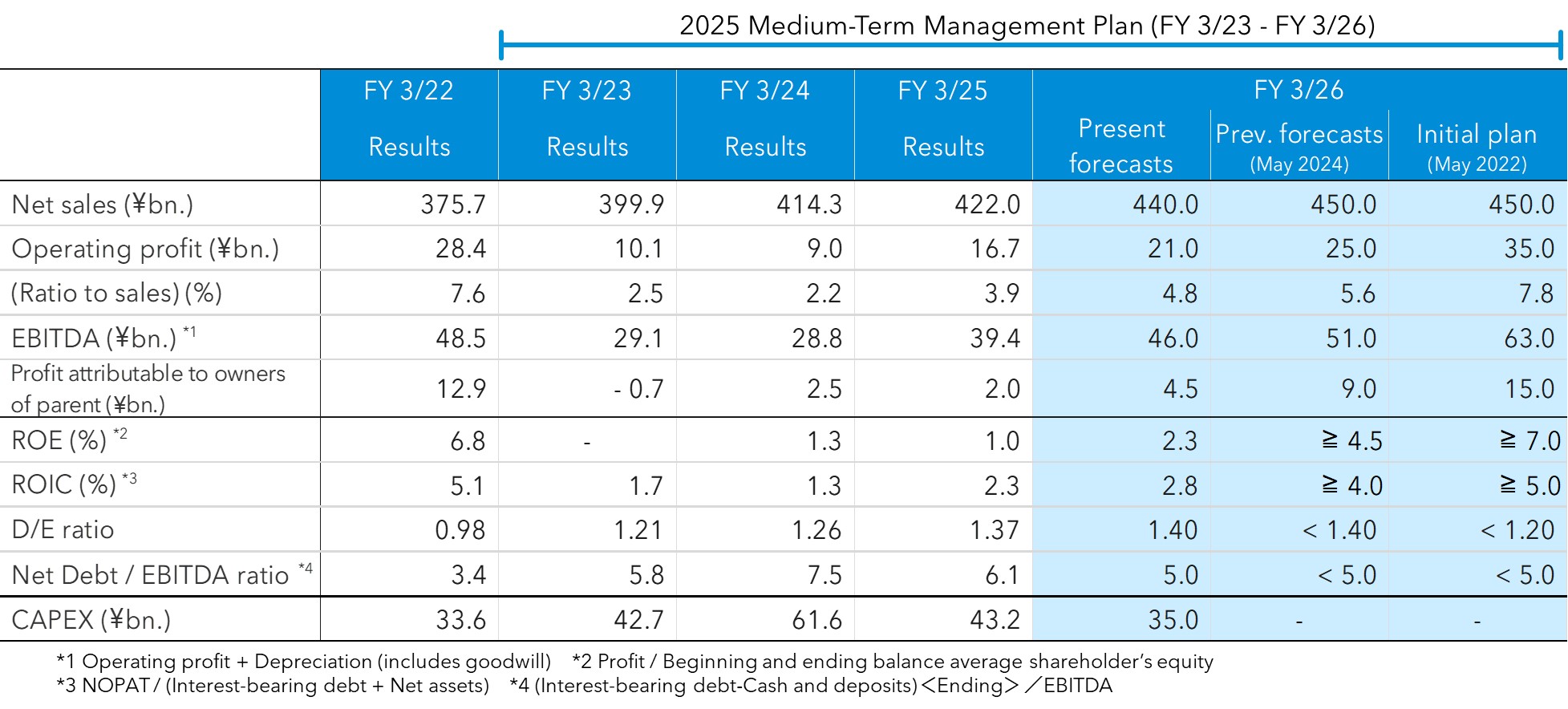

Targets of 2025 Medium-Term Management Plan are net sales of 450.0 billion yen, operating profit of 35.0 billion yen, and profit attributable to owners of parent of 15.0 billion yen.

Important financial indicators are EBITDA, the total of operating profit and depreciation, to actively make investments for sustainable growth, and Return on Invested Capital (ROIC) to promote management emphasizing capital efficiency. The company focuses on optimum allocation of management resources from both growth potential and capital efficiency.

The Group focuses on the ratio of interest-bearing debt and net assets (D/E ratio) from the perspective of maintaining and improving its bond issuer rating and ensuring stability in financing.Under our 2025 Medium-Term Management Plan, we have set our D/E ratio to under 1.2 times in order to conduct advance investment aimed at future growth without letting opportunities escape, and to control the balance between cash-flow generating capabilities and interest-bearing debt without fail, we have set the Net Debt / EBITDA ratio as an indicator, with a target of not less than 4 times to less than 5 times, and intend to manage our financial position in a stable manner. However, the business environment has undergone considerable change from initial assumptions, with a decrease in operating cash flow due to delays in a reorganization of our business portfolio compounded by an increase in interest-bearing debt due to an increase in investment cash flow resulting from large investments in growth businesses such as films and life sciences. As of March 31, 2025, our D/E ratio was 1.37 times and Net Debt/EBITDA ratio was 6.1 times, indicating a deterioration in our financial position. Under these circumstances, the forecast for FY 3/26 was set as follows.

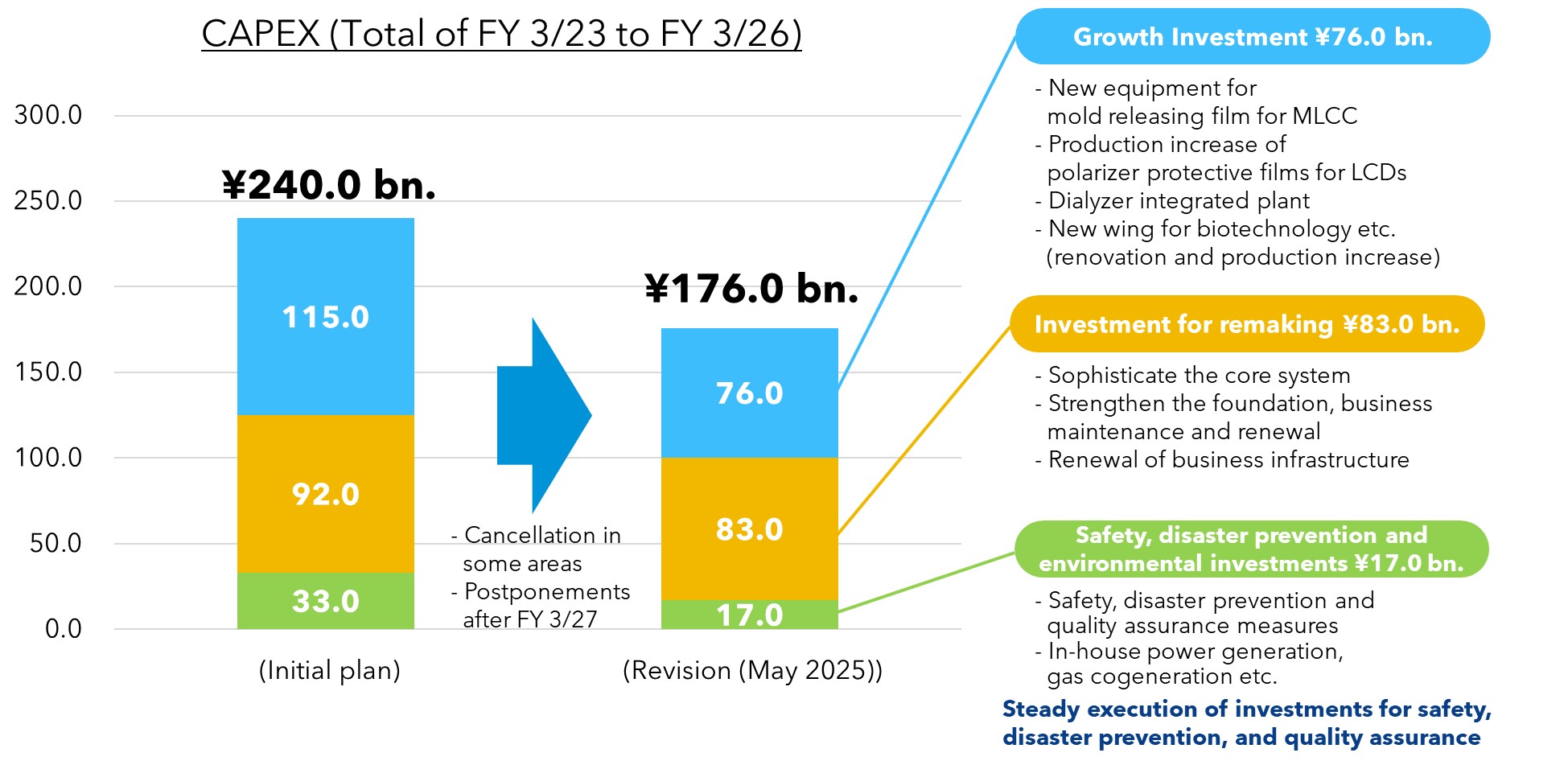

The Group had planned a four-year cumulative total of ¥240.0 billion for capital investment when the 2025 Medium-Term Management Plan was formulated (May 2022). However, in May 2024, we revised the plan to reduce this to ¥180.0 billion by reviewing investment projects. With regard to growth investment, while we steadily carried out investments in the industrial film, biotechnology, and medical businesses, we revised growth investment for packaging film, which we repositioned as a business requiring improvement. As for investment for remaking, we are reviewing these after carefully reviewing the order of priority. Regarding safety, disaster prevention and environmental investments, we are steadily implementing investments in safety, disaster prevention, and quality, while postponing certain environmental investments to FY 3/27 and beyond.

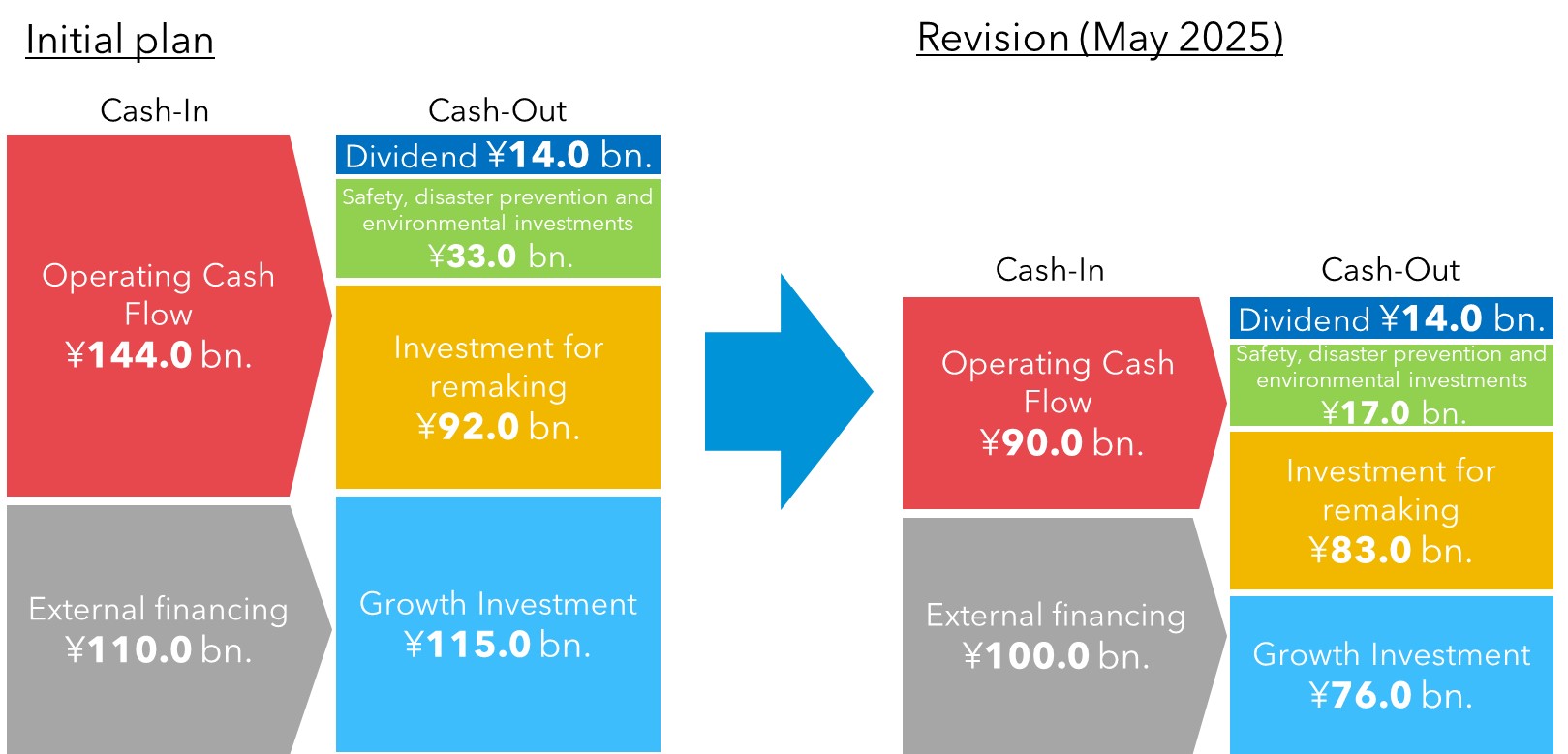

Cash flow allocation gives first priority to safety, disaster prevention and environmental responses, and at the same time, makes aggressive investment in growing businesses. It will increase external financing and the company will manage it within the range of D/E ratio to under 1.2 times, and Net Debt / EBITDA ratio of the 4 times level.

However, the business environment has undergone considerable change with a decrease in operating cash flow due to delays in a reorganization of our business portfolio. Cash flow allocation during 2025 Medium-Term Management Plan was revised as follows.

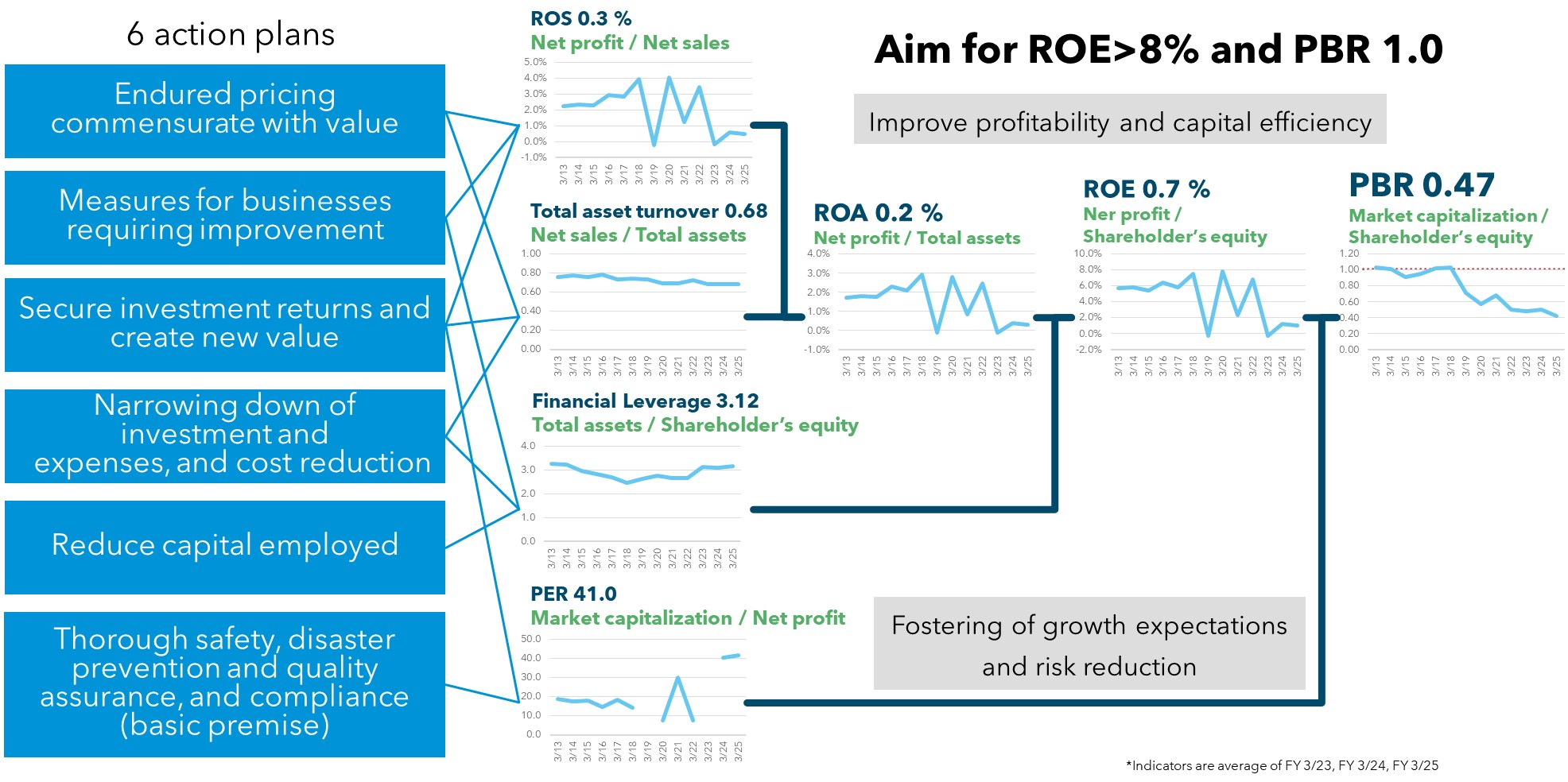

The Group takes seriously the fact that its P/B ratio is currently at a level below 1.0x, and is promoting management that is mindful of the cost of capital. In our 2025 Medium-Term Plan, we have adopted ROE and ROIC as key financial indicators, and are pursuing the improvement of the profitability and asset efficiency of the entire Group by promoting "endured pricing commensurate with value," "measures for businesses requiring improvement," "secure investment returns," "narrowing down of investment and expenses, and cost reductions," and "reduce capital employed." Concurrently, in order to raise PER, we are raising growth expectations by presenting specific measures and paths for growth through "create new value" as well as pursuing the reduction of risks through "thorough safety, disaster prevention and quality assurance, and compliance." Through these initiatives, we aim to achieve ROE of 8% or more and a PBR of 1.0x or more.

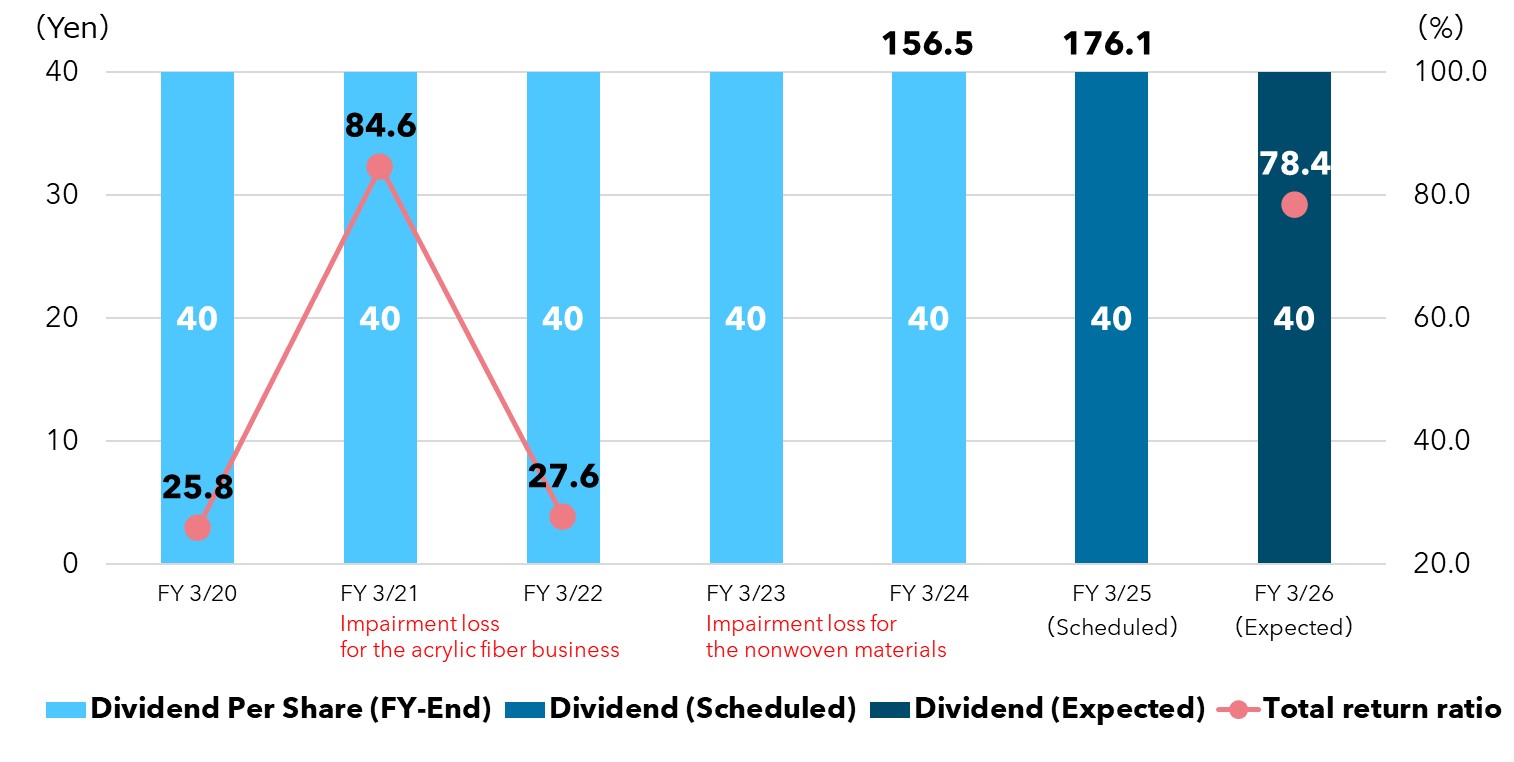

The target for the total shareholder return ratio during the term of 2025 Medium-Term Management Plan (FY 3/23 to FY 3/26) is 30%.